If you’ve been in the staffing industry for any length of time, you’ve probably heard the term WOTC (pronounced WATT SEE). You’ve also probably heard about the large amounts of paperwork, tedious recordkeeping, and lengthy time commitment to take advantage of this Federal tax credit program. Of course you can outsource this work, but not all vendors are created equal. Work Opportunity Tax Credits (WOTC) and other employee tax credit programs can be confusing, but Avionté wants to simplify these programs for staffing agencies.

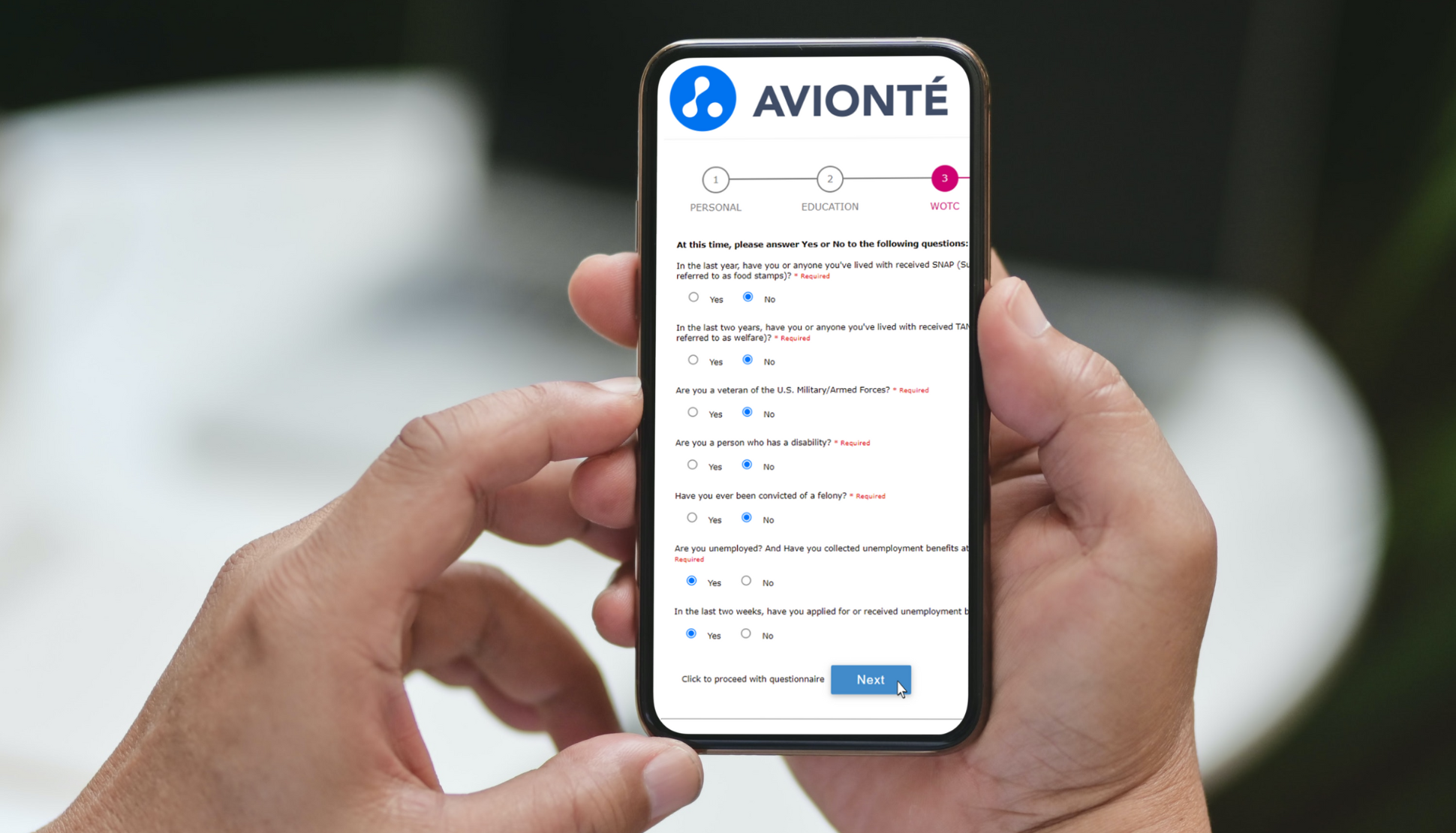

With Avionté’s integrated WOTC partners, you can set it and forget it. We’ve carefully partnered with providers that integrate with our application and onboarding workflows, which means you don’t need to worry about sending your applicants additional emails with links, collecting the right information, asking potentially uncomfortable questions to new hires, or relying on new hires to complete optional IRS forms. Our integrations automatically display the survey then pass your new-hire data to a partner, who then cast a wide net to find the most tax credits available based on your location and jurisdiction. Better yet, then that information is passed back into Avionté’s platform. The process is virtually invisible to your staffing firm and talent. That’s right, no additional email, no work arounds.

The best part is there is no upfront cost to you. All of our WOTC partners work on a success fee, meaning they share in a portion of the tax credits they find for you. This is an incentive for them to work hard and cast the widest net possible, finding your staffing agency the most WOTC and Tax Credit savings. And with the seamless integration with Avionté’s application and onboarding workflows, you don’t need to change anything you do today. This really is a rare but true win-win scenario – you only pay when tax credits are found and you do no extra work.

What is WOTC?

WOTC stands for work opportunity tax credit. This Federal program offers tax credits worth up to $2,400 per eligible new hire, and there are ten target groups that qualify.

WOTC is a Federal tax credit program, but the term WOTC has become an unofficial umbrella term for all employment tax credits. One of the most common is Disaster Zone Tax Credits, which can apply to areas throughout the United States impacted by disasters such as hurricanes, wildfires, or ice storms. These piggy-back tax credits are based on location and jurisdiction, which is why it’s so important to work with a national WOTC partner.

WOTC and CLI Staffing

On average, one in three Clerical and Light Industrial (CLI) staffing new-hires is eligible for work opportunity tax credits. You were already planning to hire these people, so why not participate in a tax credit program? The average tax credit for CLI employees is $984. This is a lot of money you potentially already qualify for!

Why Staffing Agencies Don’t Apply for WOTC Tax Credits

At Avionté, we hear two common reasons for why staffing firms do not participate in WOTC.

The first reason is a staffing firm doesn’t believe their new hires meet the qualifications for the ten target groups. If you work with a lot of white collar professionals, you may not see the same eligibility numbers that CLI staffing sees. But the tax credits for these new-hires is typically higher because they earn higher salaries. So while the volume may not be the same, the total annual savings could still be high.

The second reason is they don’t think their firm qualifies. There are so many employee tax credits available throughout the country that it makes sense to have a partner look for you. And since there is no upfront cost, you don’t stand to lose by looking. As mentioned previously, there are several piggy-back taxes that fall under the WOTC term, such as the Disaster Zone Tax Credit.

Benefits of Working with an Avionté Partner

Avionté has partnered with WOTC and employee tax credit providers that have agreements with multiple jurisdictions across the country. This means our providers can pull all relevant data to complete the IRS forms, even if your talent does not provide it. No more long hours of collecting personal data, filling out long and multiple IRS forms, and no more tracking submissions. Avionté’s platform, along with our integration partners, handle all of that for you.

Interested in Learning More?

Reach out to your Avionté account manager to learn more about our WOTC and Tax Credit integration partners.

You can also stream “Increase Your Tax Credits by 20% with One Simple Step“, our webinar on Avionté+ WOTC integrations.

Find Out Why Staffing Industry Leaders Choose Avionté